unlevered free cash flow calculator

The model assumes an 80x. LFCF builds shareholders confidenceit indicates.

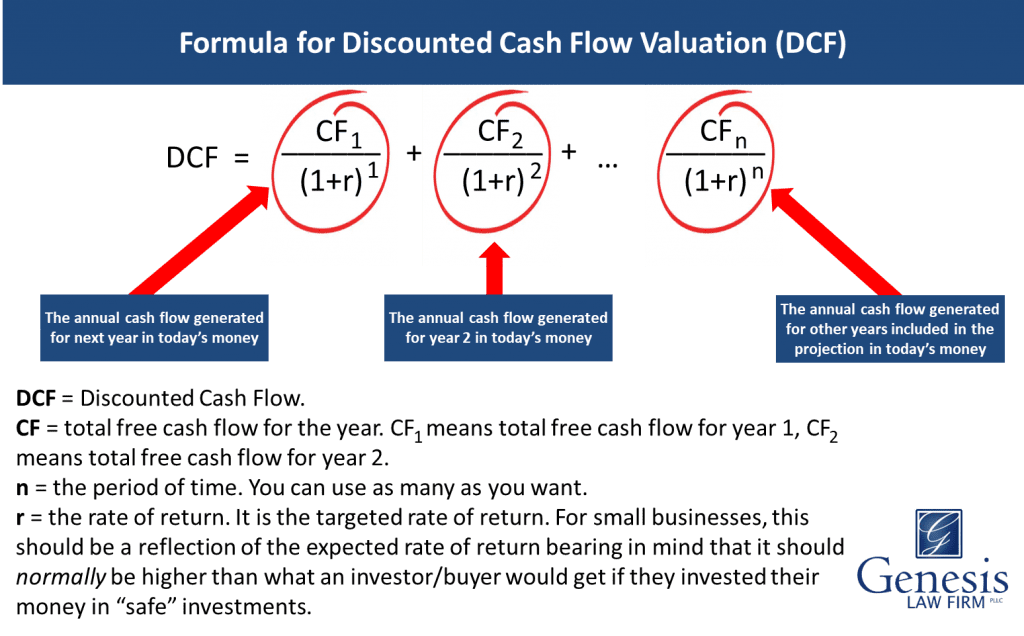

Discounted Cash Flow Analysis Street Of Walls

The internal rate of return IRR calculation is based on projected free cash flows.

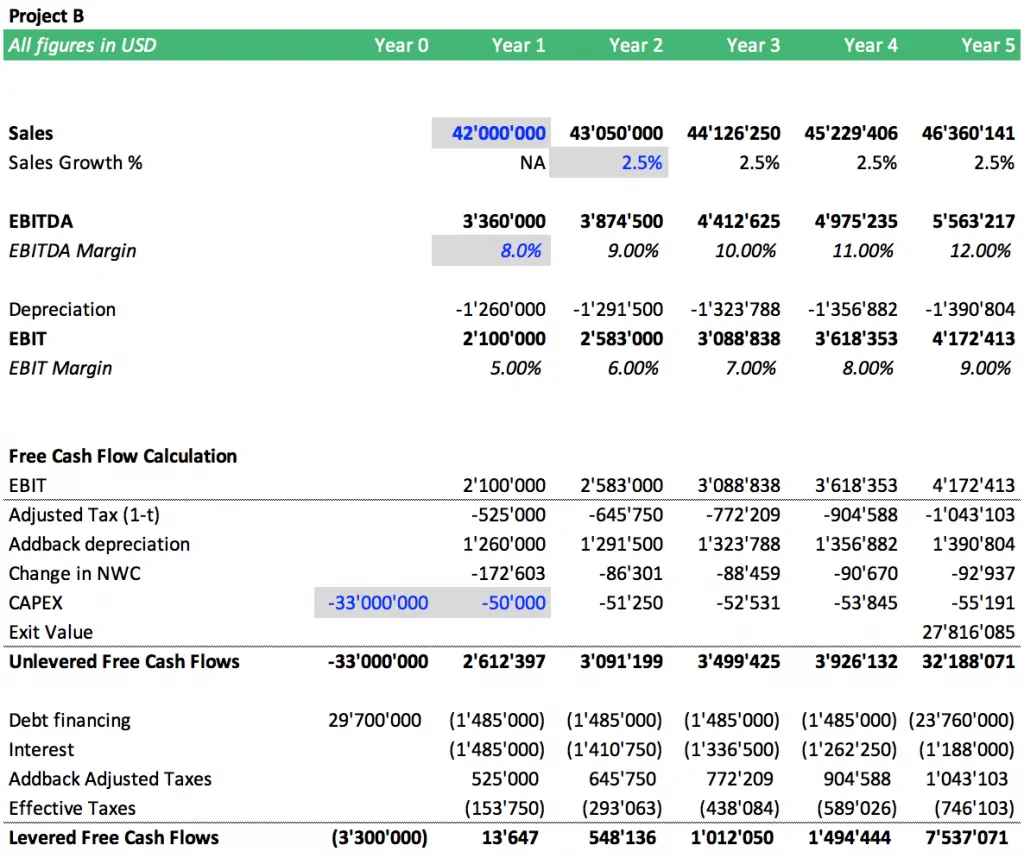

. Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. Levered Free Cash Flow Explained.

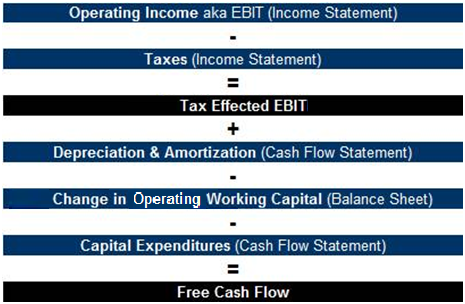

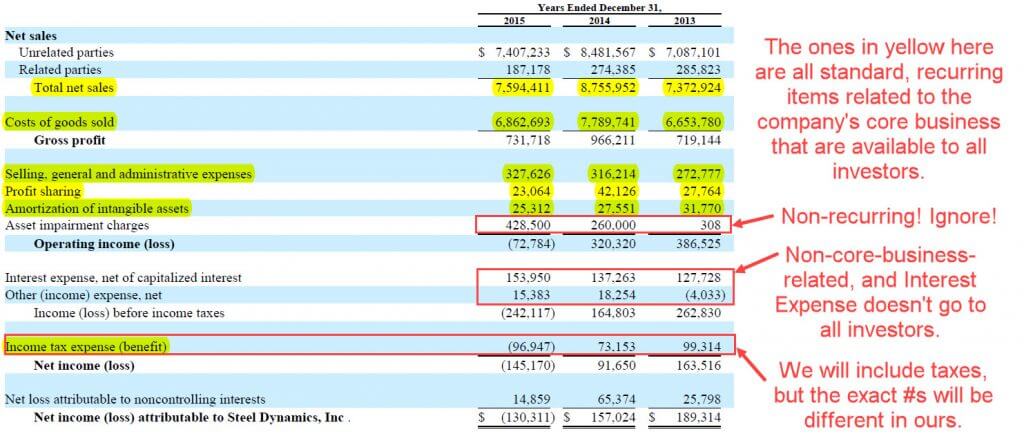

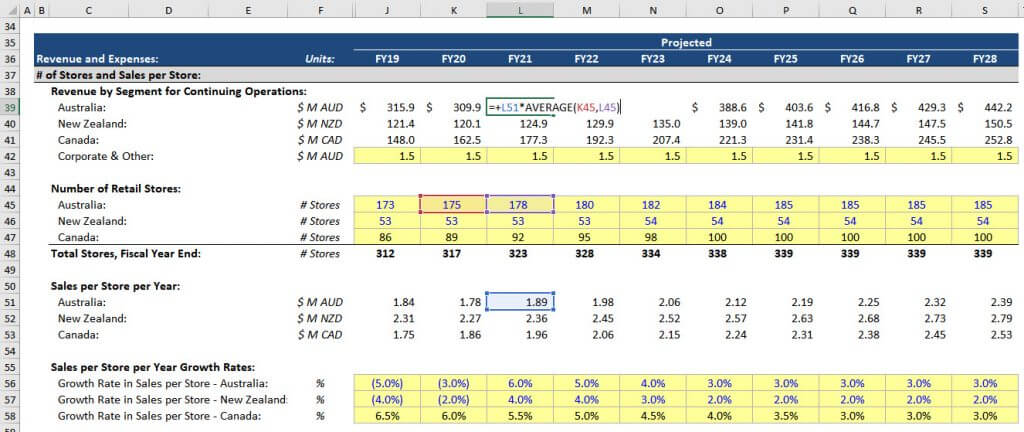

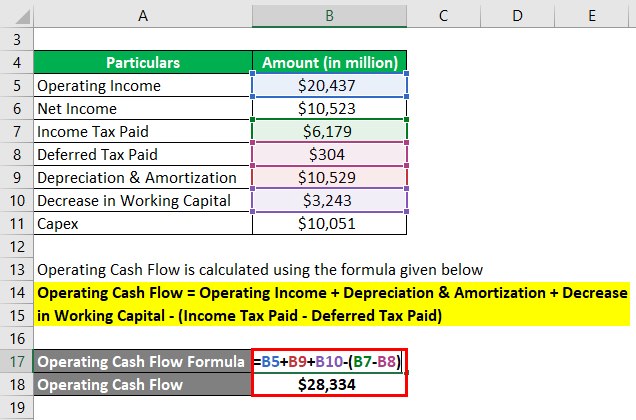

Start with Operating Income EBIT on the companys. A business or asset that. How to Calculate Unlevered Free Cash Flow UFCF Unlevered free cash flow or UFCF represents the cash flow left over for all capital providers such as debt equity and preferred.

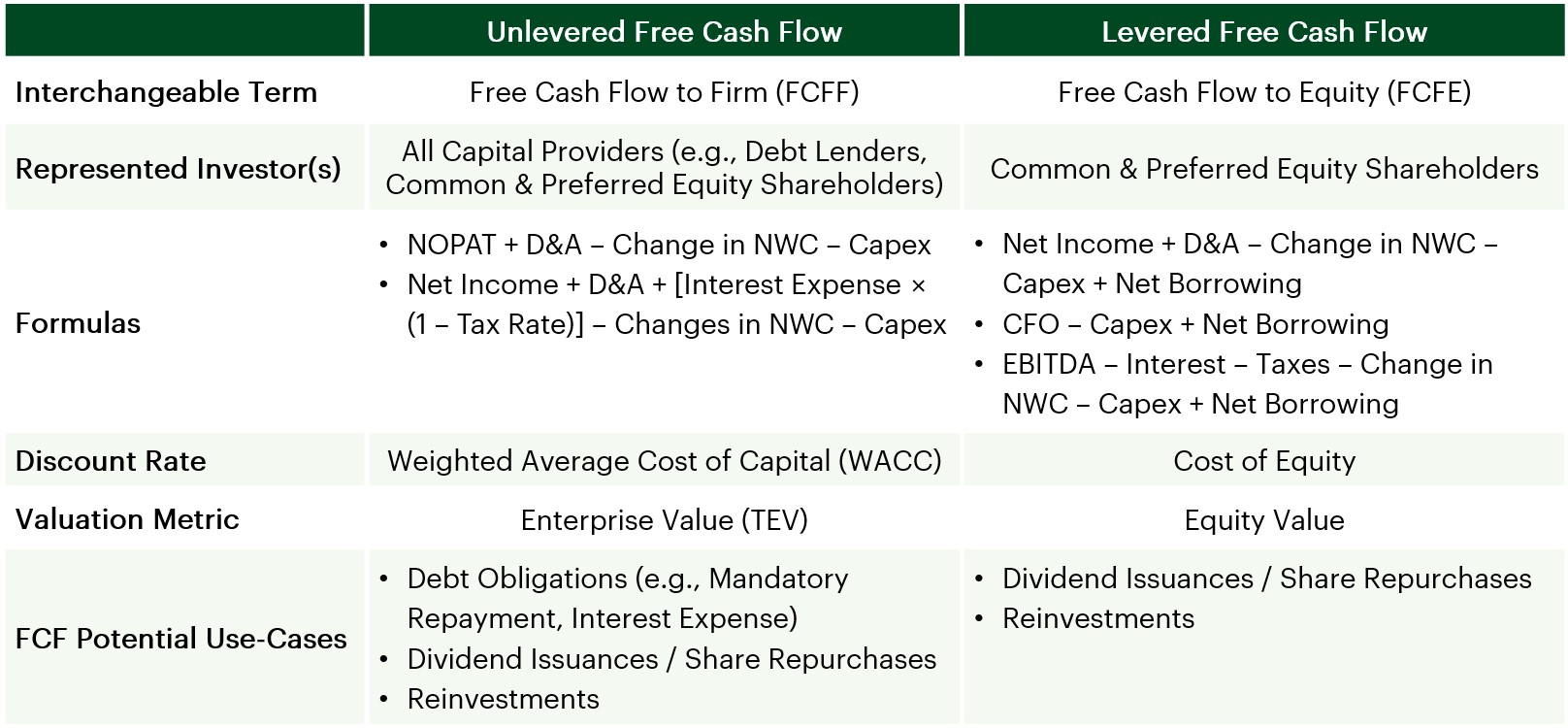

Unlevered Free Cash Flow aka Free Cash Flow to the Firm UFCF and FCFC for short refers to a Free Cash Flow available to all investors. 21 Definition of Unlevered Free Cash Flow. The differentiator between these metrics is the way they treat debtWhen debt principle payments and interest are included in the.

Table of Contents for Video. Basic Definition of Levered FCF and Excel Demo 510. Unlevered Free Cash Flow.

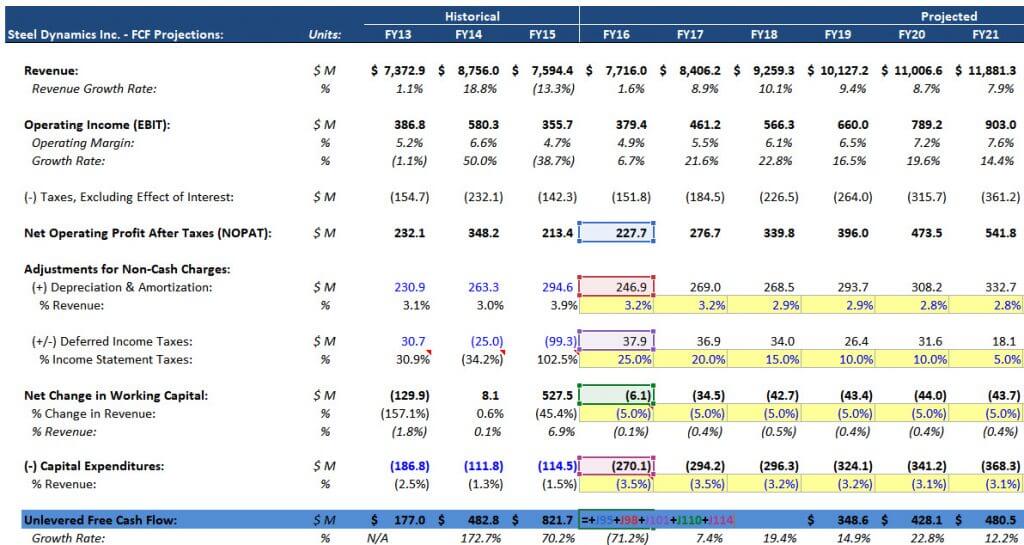

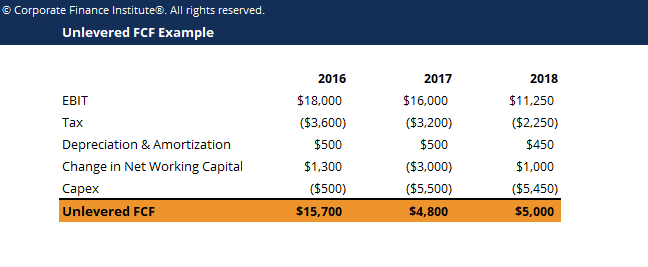

Internal Revenue Code that lowered taxes for many US. Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx. A complex provision defined in section 954c6 of the US.

Unlevered FCF growth should slow down. Unlevered Free Cash Flow Formula. Let us look at an example of unlevered cash.

Below is an example of a DCF Model with a terminal value formula that uses the Exit Multiple approach. Guide to What is Unlevered Free Cash Flow UFCF. How to calculate unlevered free cash flow.

What is unlevered free cash flow and how to calculate it 6 min read Reading Time. Changes Required in a Levered DCF Analysis 1044. Example from a Financial Model.

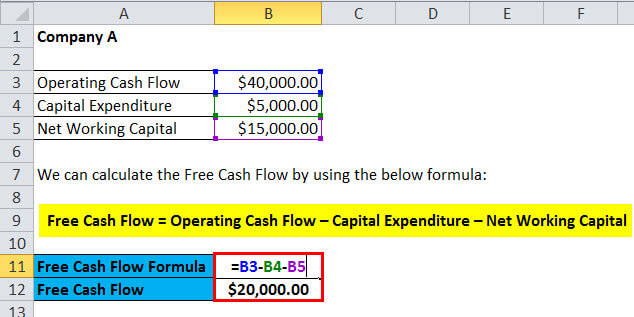

You can see the entire formula in Excel below. Unlevered free cash flow earnings before interest tax depreciation and amortization - capital expenditures - working. Unlevered free cash flow removes all of these debt payments from the picture.

We explain its formula calculation example and comparison with levered free cash flow. The formula for UFCF is. Unlevered free cash flow doesnt imply that a business wont meet its financial obligations but.

The look thru rule. The IRR is equal to the discount rate which leads to a zero Net Present Value NPV of those. Before understanding unlevered free cash flow well break down the terms.

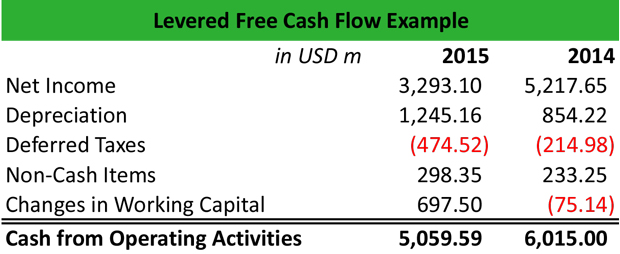

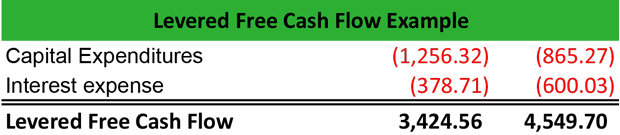

Levered Free Cash Flow. The levered free cash flow LFCF meaning implies a crucial figure in a companys accounting books. Unlevered Free Cash Flow.

Unlevered Free Cash Flow For Dcf Modeling Keyskillset

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

What Is Levered Free Cash Flow Definition Meaning Example

Understanding Levered Vs Unlevered Cash Flow In Real Estate Fnrp

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Financial Modeling Dcf Model Ms Excel Excel In Excel

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Formula Calculator Excel Template

How To Calculate Unlevered Free Cash Flow In A Dcf

Irr Levered Vs Unlevered An Internal Rate Of Return Example Efinancialmodels

Free Cash Flow Yield Formula And Calculator

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Free Cash Flow To Firm Fcff Formula And Calculator

Cash Flow Formula How To Calculate Cash Flow With Examples

Levered Vs Unlevered Free Cash Flow What S The Difference Analyst Answers

Unlevered Free Cash Flow Definition Examples Formula Wall Street Oasis

Unlevered Fcf Template Download Free Excel Template