vehicle personal property tax richmond va

The 10 late payment penalty is applied December 6 th. At the calculated PPTRA rate of 30 you would be required to pay.

Richmond Extends Deadline To Pay Personal Property Taxes Wric Abc 8news

Vehicle License Tax Antique.

. Property Tax Vehicle Real Estate Tax. Then receipts are allocated to these taxing entities according to a standard plan. Electronic Check ACHEFT 095.

Personal Property Taxes. Code of Virginia 581 3668 B is very clear that the vehicle must be owned by either the veteran or jointly owned with the spouse. 295 with a minimum of 100.

As June 5 falls on a Sunday all payments postmarked on or before June 6 will not be subject to penalties and interest for late payment. The Vehicle Registration Fee is 3300 per annum and is administered directly by the City Treasurer click here to e-mail the Treasurer. Answer the following questions to determine if your vehicle qualifies for personal property tax relief.

WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the payments. The owners of vehicles that qualify for property tax relief PPTR receive a full or partial exemption on the first 20000 of assessed value of the vehicle. Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill.

Taxpayers can either pay online by visiting RVAgov or mail their payments. An example provided by the City of Richmond goes like this. Personal property tax bills have been mailed are available online and currently are due June 5 2022.

If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed value. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons. Typically taxing entities tax levies are combined under a single bill from the county.

This maximum threshold has not been revised since the legislation was signed. The current personal property tax rate is 413 per 100 of assessed value. For additional information please visit the Finance Department Revenue Division website or call 804 501-7329.

The Commissioner of the Revenue determines the method of assessment for personal property and the City Council establishes the tax rate. Personal Property Taxes are billed once a year with a December 5 th due date. Interest is assessed as of January 1 st at a rate of 10 per year.

The original legislation required the property to be in the name of the veteran. Parking Violations Online Payment. This situation is identical to the Disabled Veterans real estate tax exemption effective January 1 2011.

Circuit Court Clerk for the City of Richmond VA. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. Tax Return Filing Date Purchases of vehicles and disposal of vehicles are required to be reported to the Commissioners Office within 30 days of either the purchase or disposal and not later than January 31 of each year following.

On Tuesday the council voted. Qualifying vehicles with an assessed value of 1000 or less receive a full exemption from the personal property tax. A vehicle registration fee continues to be assessed on each of the above personal property types according to class and weight.

COVID-19 IMPACT TO VEHICLE VALUES FOR 2022. Vehicle License Tax Motorcycles. Personal Property Registration Form An ANNUAL filing is required on all.

Team Papergov 1 year ago. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Personal Property taxes are billed annually with a due date of December 5 th.

If your vehicle is valued at 18030 the total tax would be 667. Personal Property Tax. The actual cost to the county for this tax relief was 23 million.

Cut the Vehicle License Tax by 50 to. I need to get my cars or trucks license plates renewed. Vehicle License Tax Vehicles.

Car Tax Credit -PPTR. Is more than 50 of the vehicles annual mileage used as a business. Taxpayers now have until August 5 2022 to pay personal property tax car tax and machinery tools tax without penalty or interest.

There are three basic steps in taxing property ie formulating levy rates assigning property. Broad Street Richmond VA 23219. The tax rate is 1 percent charged to the consumer at the time of rental payment.

Tax Due Date Extended by City Council Action At a Special Meeting this week City Council unanimously approved the extension of the 2022 due date for both personal property taxes and machinery tools taxes. Real Estate and Personal Property Taxes Online Payment.

How To Lower Property Taxes 7 Tips Quicken Loans

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Pay Online Chesterfield County Va

Henrico County Announces Plans On Personal Property Tax Relief

The Hidden Costs Of Owning A Home

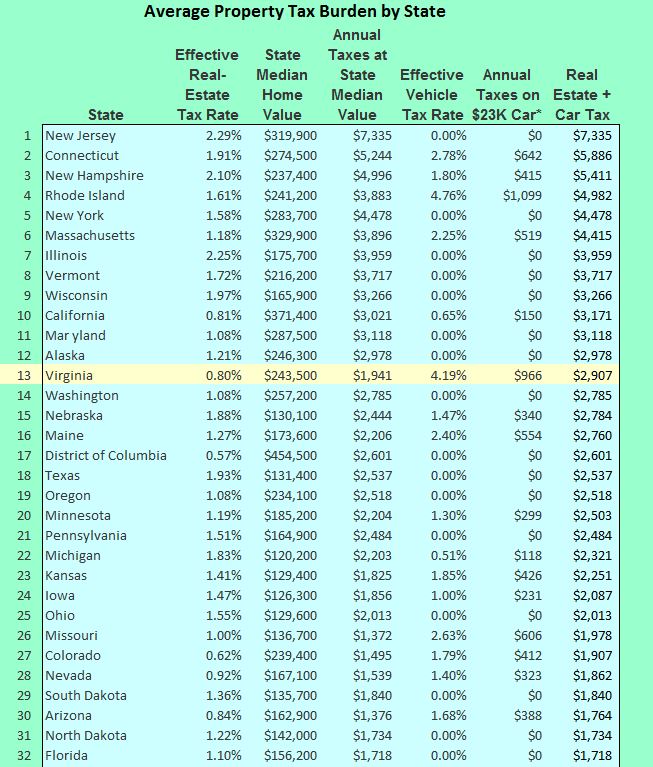

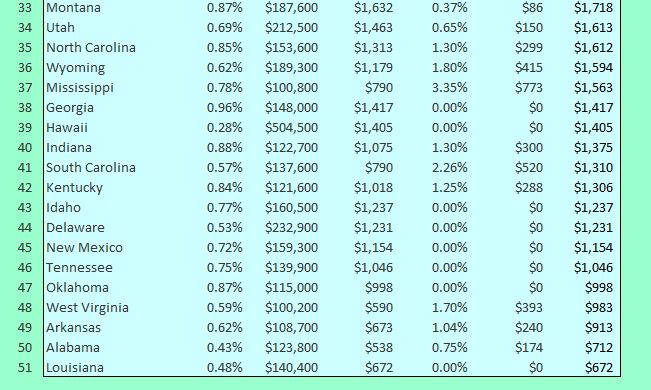

Property Taxes How Much Are They In Different States Across The Us

Personal Property Tax Deadline For Goochland Residents Extended With Interest Payments Penalties Waived Wric Abc 8news

Aba Tax Services Xero Accountant Property Business And S M S F Specialists Business Insurance Small Business Insurance Car Insurance

Virginia Localities Pushing Tax Relief As Car Values Go Up Dcist

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

Many Left Frustrated As Personal Property Tax Bills Increase

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

Virginia S Personal Property Taxes On The Rise 13newsnow Com

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion